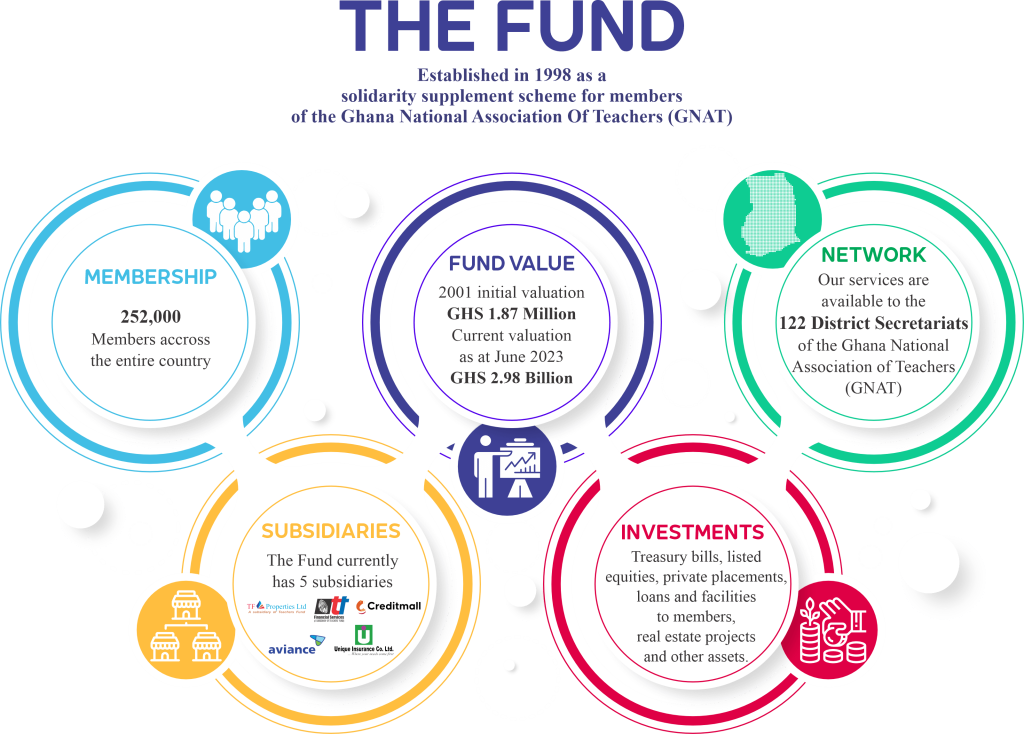

THE TEACHERS FUND IS A RETIREMENT SUPPLEMENT

SCHEME FOR THE GHANA NATIONAL ASSOCIATION OF TEACHERS

(GNAT) ESTABLISHED BY A TRUST DEED IN MAY 1998.

OUR PRODUCTS

There are four main loan facilities that members of the Fund can access to meet their financial needs.

Personal Loan

This loan facility has been designed to assist members meet their short-term financial obligations such as payment of School fees, rent advance and any other general repairs at home.

Habitat Loan

This facility has been put together to support a greater number of GNAT members who desire to solve their accommodation challenges or aspire to build their homes before they retire from active service.

Investment Loan

More often than not, members of the Fund have business ideas for which they need funds to finance. The Investment Capital Loan facility has been designed for this purpose.

Vehicle Loan

This facility is meant to finance the purchase of vehicles by loan applicants. It is the only loan facility at the Fund that cheques are not written in the name of the applicant rather it is in the name of the vehicle vendor.

MEMBER BENEFIT

Contributions

As a member of the Teachers’ Fund, one is expected to make a monthly contribution to the Fund which is then invested on behalf of the member. There are two category of member contributions- the Basic contribution and the Optional contributions.

Group Solidarity

Members are eligible for the group solidarity package in the event of death and permanent disability. Upon the death of a member, a package comprising his total contributions together with his accumulated return and an amount of GHC 500.00 is paid to the next of kin

Retirement

Each member is entitled to an exit package of a lump sum from the Fund on retirement. This lump sum package is made up of one’s total contributions and the Interest that the amount has generated over the years. Exit package for deceased members are paid to their Next of Kin.

Death

Upon the death of a member, an exit package is calculated and paid to the deceased member’s nominated Next of Kin (Beneficiaries) according to the percentage allocation as determined by the member whilst he/she was alive.

RETIRE IN STYLE WITH TEACHERS FUND

Total Contribution + Return on Investment = Retirement Lump Sum

TESTIMONIALS

See what our customers have to say about our products, people and services.

We are very proud of you all !

CHANGE IN BASIC CONTRIBUTIONS

In February 2017, the basic contribution was GH₵50.00. The basic contribution was further reviewed upwards to GHC100.00 with effect from January 2024.

TEACHERS’ FUND HOLDS ITS 2020 ANNUAL GENERAL MEETING

The 2020 Annual General Meeting of the Teachers’ Fund came off successfully on Saturday 13th November 2021 at Ejisu-Abankro in the Ashanti Region.